Take Action: Vote No on School Vouchers

2/11/26

A stealth referendum question about school vouchers may be on your ballot on March 17! Here's what to know:

Illinois law enables voters or lawmakers to add up to three non-binding questions (per political subdivision, e.g. county) on election ballots to be voted for or against. These are also known as advisory referenda or ballot measures.

On March 17, about 10% of Illinois voters will have a non-binding question on their primary ballot about whether Illinois should opt into the federal school voucher program. You can check on this list to see if your county (or, in a few cases, your township) will have the ballot question.

Concerningly, the question is misleadingly worded (see details below). It implies that the program will not redirect public dollars to fund private schools and does not include the word voucher.

We urge all voters to vote NO on the question about the federal school voucher program.

The results of these ballot questions have no legal impact; the decision about whether Illinois joins the federal school voucher program is up to Governor Pritzker and the General Assembly.

However, school voucher supporters are likely to use any favorable results as an indicator of public support for vouchers.

Historically, school vouchers have lost on the ballot every time voters have been asked to weigh in since 1970, including the 2024 general election, where voters in Kentucky and Nebraska soundly rejected them by about 2:1. Voucher proponents know that school vouchers aren’t popular with voters, which explains the deceptive wording on this latest question, describing the program as a federal program that distributes private dollars:

Should Illinois opt into a federal program that would provide public K-12, private school, and homeschool students with privately donated funds for academic needs, such as tutoring and test preparation, educational therapies for students with disabilities, tuition, books, exam fees or for other specified academic needs?”

Voters reading their ballot carefully may ask: why would you need a federal program to distribute private money? The answer is that the federal voucher program spends public dollars. It will divert billions of tax dollars from the US Treasury to fund mostly private education around the country. There is no limit on the size of the program in the statute, but estimates are upwards of $25 billion a year.

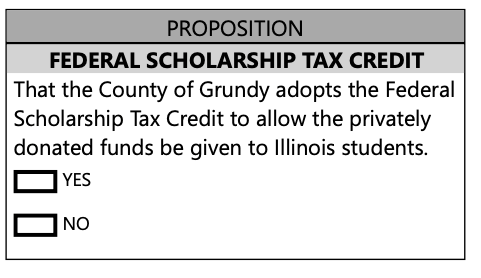

Because each of these advisory questions were approved by different jurisdictions, the wording may vary! Here's the wording on the Grundy County ballot, for example:

More about the federal school voucher program

The federal school voucher program, set to begin in January 2027, is structured as a tax credit scholarship program, like Illinois’ now-defunct school voucher program, known as “Invest in Kids.” Tax credit scholarship vouchers let taxpayers divert some portion of the taxes they owe to third-party “scholarship granting organizations” (SGOs).

These SGOs then distribute the money as vouchers to pay for private school tuition and fees, mostly at religious schools.

Regulations to implement the program are not yet finalized, but all indications thus far are that the SGO industry will be dominated by large multi-state organizations (e.g. a Florida SGO with ~$1B in revenue last year), with one already seeded a $10 million campaign fund to promote school vouchers.

The money given to SGOs would otherwise be collected as tax payments, and courts have ruled that legally these are public funds.

“There is nothing ‘private’ or ‘charitable’ about the funding of the AGOs [scholarship granting organizations], and this funding mechanism is not a ‘donation’ in any meaningful sense of that word that connotes a voluntary contribution of personal or business income.

These taxpayers are not donating their own money to AGOs; they are taking the money they owe to the state in income taxes, and re-directing it to the AGOs, as authorized by this legislation.”

—Council for Better Education v Johnson

School voucher programs were created to fund private schools with tax dollars , and the federal one is likely to be no different—despite the fact that in theory some dollars could go to SGOs that distribute money for individual public school families’ expenses. The overall drain on public school budgets if even a small percentage of students leave for private schools will be in the hundreds of millions of dollars, far outweighing any revenue from SGOs to public school students.

Opting into the federal school voucher program will undoubtedly and irreversibly erode Illinois' public school funding—which is why we urge all voters to vote NO on this ballot question to send a clear message: Illinois says NO to vouchers.

Sign up to get our Action Alerts on your phone!

Use the League in Action app to take action on issues impacting Illinois communities—here’s how to sign up:

Download the app on your cell phone (available via the App Store and Google Play)

Sign in with your Google or Facebook account, or create an account with your email

Search for the League of Women Voters Illinois on the app and click the Join button

Scroll through the feed to see all of the ways you can support LWV's efforts